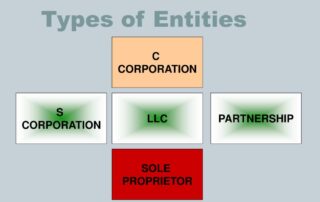

Real Estate Investors and Choice of Entity/Tax Deductions

Episode 6: Win the Tax Game. In this 40 minute presentation, I discuss choice of business entities for real estate investors and some common missed tax deductions with Attorneys Stephanie Long and Peter McFarland. https://www.youtube.com/watch?v=wjosqKJCP8k