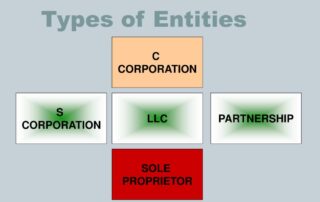

New Businesses and Choice of Entity

Episode 5: Win the Tax Game. On this episode, Attorney Peter McFarland joins me for a discussion on choice of business entity- very valuable information for any new business- LLC, corporation or something else? https://www.youtube.com/watch?v=e9Ct6KnVF3M